what is suta tax rate for california

Review the PIT withholding schedule. The 2020 California employer SUI.

Unaffordable California It Doesn T Have To Be This Way

Like SUTA wage bases SUTA rates also.

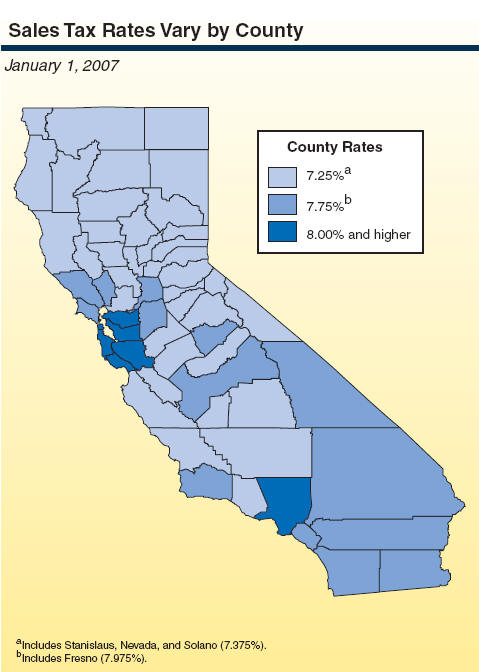

. For example the wage base limit in California is 7000. The new employer SUI tax rate remains at 34 for 2021. The SUI taxable wage base for 2020 remains at 7000 per employee.

FICA tax is a 62 Social Security tax and 145 Medicare tax. New Hampshire has raised its unemployment tax rates for the second quarter of 2020. The SUI taxable wage base for 2021 remains at 7000 per employee.

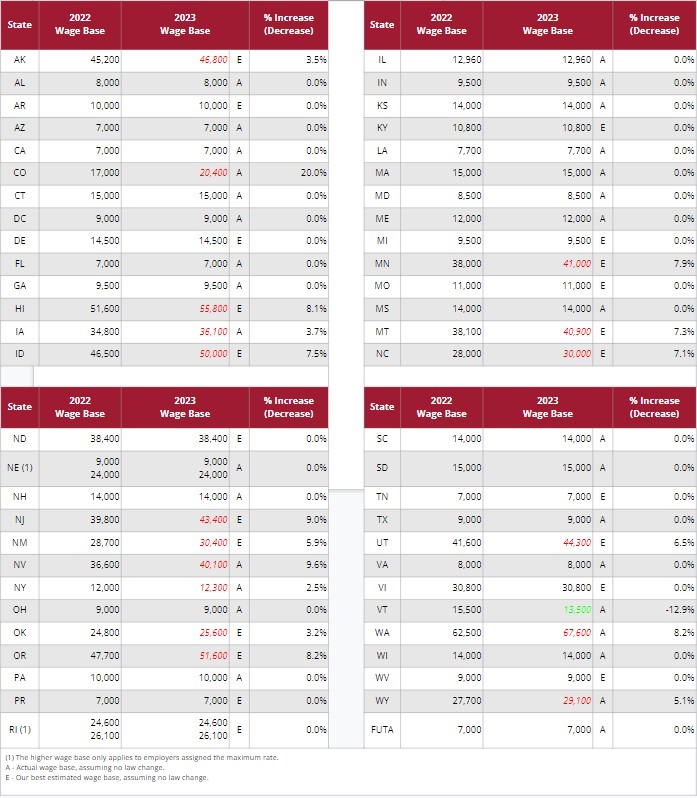

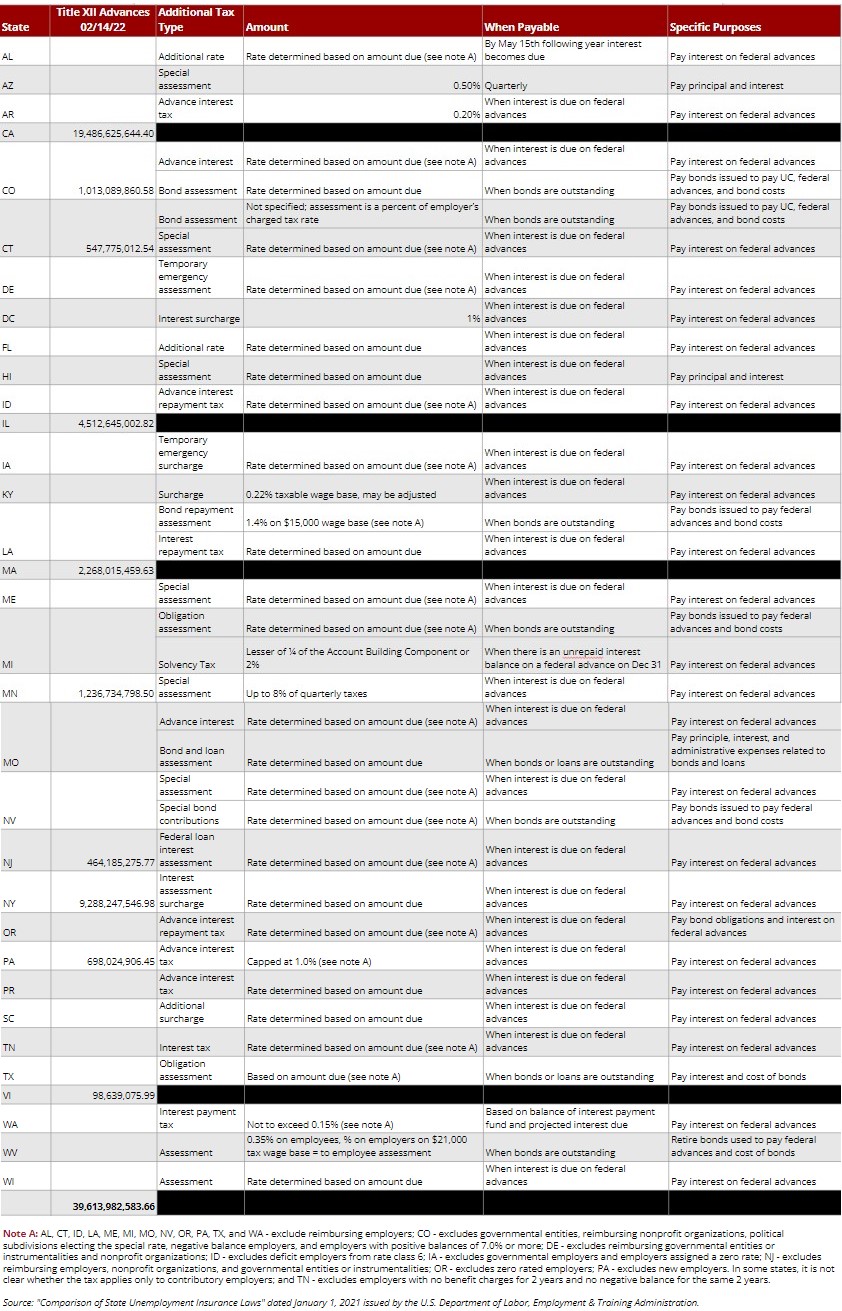

Most states send. Effective January 1 2022. State unemployment tax rates.

Each state has its own limit for the wage base subject to SUTA taxes. Stay up-to-date with your SUTA wage base to ensure youre withholding the correct amount of SUTA tax for each employee. Employers report their tax liability annually on IRS Form 940 but quarterly tax deposits may be required.

Below is a chart with the. According to the EDD the 2021 California employer SUI tax rates continue to range from 15 to 62 on Schedule F. What is the current SUTA rate for 2020.

Tax rates for the second quarter range from 01 to 17 for positive-rated employers. Once the low rate is achieved large payroll amounts from another related corporation are transferred into this account. 52 rows You may receive an updated SUTA tax rate within one year or a few years.

There is no maximum tax. As a result of the ratio of the California UI Trust Fund and the total wages paid by all. There is no taxable wage limit.

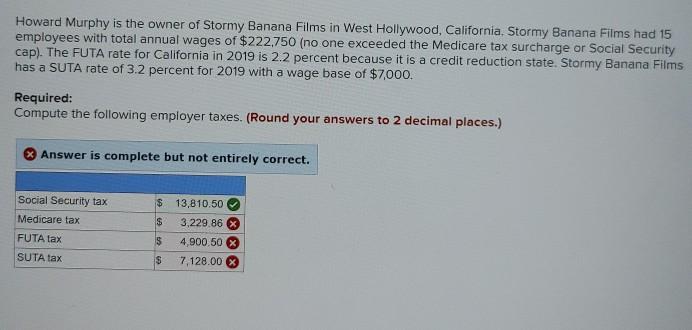

The maximum FUTA tax an employer must pay per employee per. The withholding rate is based on the employees Form W-4 or DE 4. The State Unemployment Tax Act SUTA tax is a type of payroll tax that states require employers to pay.

Lets say that your tax rate the percentage you pay on the wage base limit is 5 and you have 3 employees. To calculate your SUTA tax as a new employer multiply your states new employer tax rate by the wage base. The California Employment Development Department has confirmed that unemployment tax rates are unchanged for 2022 on its website.

Standard rate 257 207 employer share. The amount of the tax is based on the employees wages and the states unemployment rate. Employers in California are subject to a SUTA rate between 15 and 62 and new non-construction businesses pay 34.

In the State Tax Information information find your SUI rate. New Employer Rate An employer with a high UI rate files a. What is the SUTA rate for 2021.

4 rows Imagine you own a California business thats been operating for 25 years. State SUTA new employer tax rate Employer tax rate range SUTA wage bases Alabama. For example if you own a non-construction business in California in.

065 68 including employment security assessment of.

View All Hr Employment Solutions Blogs Workforce Wise Blog

2022 Federal Payroll Tax Rates Abacus Payroll

Howard Murphy Is The Owner Of Stormy Banana Films In Chegg Com

California Tax Forms H R Block

California Tax Rates Rankings California State Taxes Tax Foundation

Solved The Unemployment Tax Rate For Washington Dc Is Incorrect The Amount I Was Taxed By Dc And What Qb Thinks I Should Be Taxed Are Different How Do I Resolve This

California S Tax System A Primer

Idaho 2022 Sales Tax Calculator Rate Lookup Tool Avalara

What Is My State Unemployment Tax Rate 2022 Suta Rates By State

Sui Definition And How To Keep Your Sui Rate Low Bench Accounting

The Income Gap Unemployment And Tax Rates Visual Ly

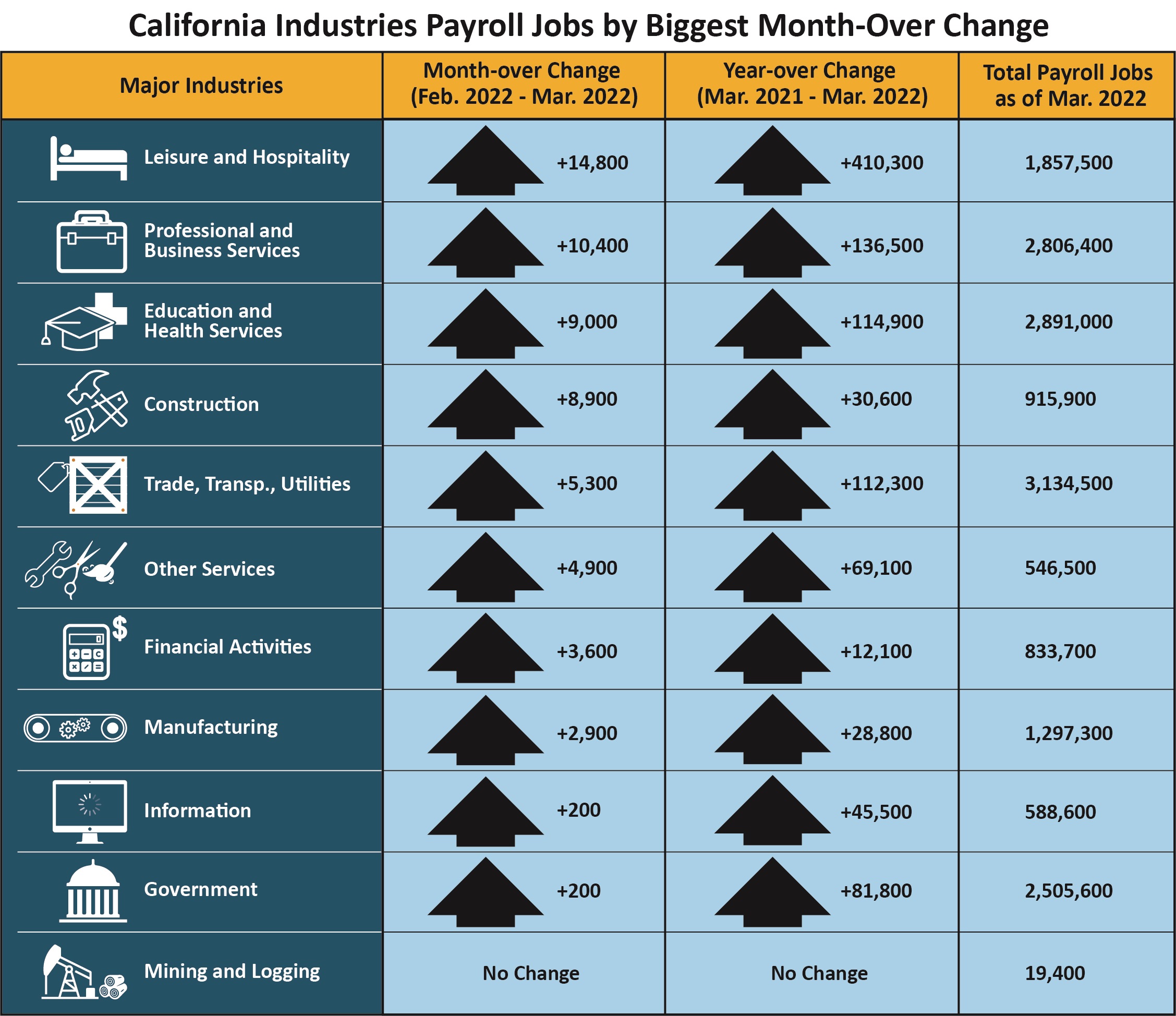

California S Unemployment Falls To 4 9 Percent For March 2022

Will Michigan Lower Its Tax Rates Here S How We Compare To Other States Mlive Com

What Are California S Income Tax Brackets Rjs Law Tax Attorney

View All Hr Employment Solutions Blogs Workforce Wise Blog