vermont department of taxes homestead declaration

Instantly Find and Download Legal Forms Drafted by Attorneys for Your State. You are the owner or co-owner of the property.

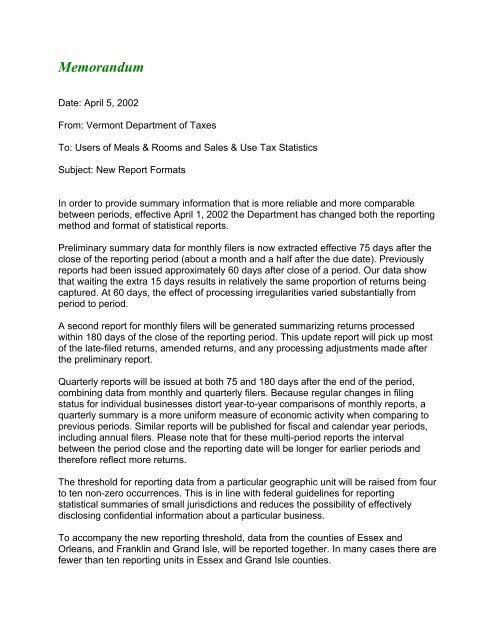

To Read Memo On New Statistical Report Formats State Of Vermont

Residing in A Dwelling Owned By A Related Farmer If a dwelling is owned by a farmer or farm corporation the dwelling is on the farm property and it is occupied by a parent child sibling or grandchild of the farmer as his or her principal residence the dwelling is a homestead.

. The new myVTax guide released by the Vermont Department of Taxes How to File a Homestead Declaration or Homestead Declaration Property Tax Credit Claim takes filers step by step through the. Town Offices 86 Mountain Rd. January 28 2020.

Information on upcoming tax filing deadlines and these programs is available on the departments website at taxvermontgov. Quick steps to complete and e-sign Vt homestead declaration online. Filing online through the Vermont Department of Taxes new online system myVTax has been mandated by the Commissioner of Taxes beginning with the tax year ending Dec.

15 2019 but the town may assess a penalty. All taxpayers may file returns and pay tax due for Withholding Tax using myVTax our free secure online filing site. Taxpayers having trouble filing Homestead Declarations and Property Tax Credit Claims may call 802 828-2865 for help.

A Vermont homestead is taxed at the homestead education property tax rate while a different education property tax rate applies to non-homestead property. Pay Estimated Income Tax by Voucher. Montpelier VtThe Vermont Department of Taxes 5102021.

Use myVTax the departments online portal to e-file Form HS-122 Homestead Declaration and Property Tax Adjustment Claim and Schedule HI-144 Household Income with the Department of Taxes. Route 242 Montgomery Center VT 05471 802 326-4719 More information. Check Return or Refund Status.

Use the Cross or Check marks in the top toolbar to select your answers in the list boxes. GB-1071 - Form HS-122. If your homestead is leased to a tenant on April 1 you may still claim it as a homestead if it is not leased for more than 182 days in the 2020 calendar year.

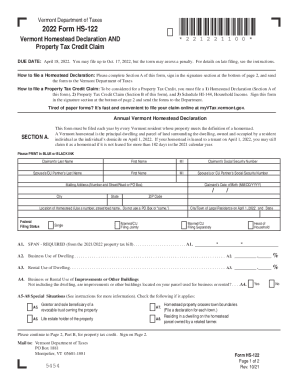

The Vermont Homestead Declaration By Vermont law property owners whose homes meet the definition of a Vermont homestead must file a Homestead Declaration annually by the April due date. For details on late filing see the instructions. To be considered for a Property Tax Credit you must file a 1 Homestead Declaration Section A of this form 2 Property Tax Credit Claim Section B of this form and 3.

Filing a Homestead Declaration is easy and can be done online at the Vermont Department of Taxes website. Vermont Homestead Declaration AND Property Tax Adjustment Claim 2019 Form HS-122 DUE DATE. Guide Tue 03292022 - 1200.

Homestead Declaration and Property Tax Adjustment Filing Vermontgov. Ad Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms. Please complete Section A of this form sign in the signature section at the bottom of page 2.

If your home is leased to a tenant the lease does not extend beyond 182 days in the calendar year. If eligible you must file so that you are correctly assessed the homestead tax. Pay Estimated Income Tax by Voucher.

You must file and pay electronically if. You may file up to Oct. The definition of a homestead is as follows.

How to file a Homestead Declaration. You will need to file a separate Vermont Homestead Declaration in each town. 802 828-2865 133 State Street Montpelier VT 05633-1401 For Department Use Only DOMICILE STATEMENT For the taxable year ending _____ Unless otherwise indicated the questions pertain to the year specified above.

Vermont tax accountant cpa. Even if you do not believe you owe property taxes you must declare homestead in order to qualify for Property Tax Adjustment. How to Download and Report to the Vermont Department of Taxes.

If your property fulfills the criteria to be declared a homestead you can file a Vermont homestead declaration and property tax adjustment every year. Commercial and Industrial Site Locator. Pay Estimated Income Tax Online.

Start completing the fillable fields and carefully type in required information. Please complete Section A of this form sign in the signature section at the bottom of page 2 and send the form to the Vermont Department of Taxes How to file a Property Tax Credit Claim. If you do not file by this date then you will receive a penalty.

The form to the Vermont Department of Taxes How to file a Property Tax Credit Claim. Domicile Statement Property Tax Homestead Declaration Domicile Statement Vermont Department of Taxes Phone. Mon 01242022 - 1200.

The property is your primary residence as of April 1 each year. Both electronic filing and form HS-122 may be found online at the Department of Taxes website at wwwtaxvermontgov. When a portion of the property is the homestead and a portion is used for business purposes or rented the following rules apply for reporting the use on Form HS-122 Homestead Declaration.

Pay Estimated Income Tax Online. To be considered for a Property Tax Credit you must file a 1 Homestead Declaration Section A of this form 2 Property Tax Credit Claim Section B of this form and 3 Schedule HI-144 Household Income. Use Get Form or simply click on the template preview to open it in the editor.

Department of Taxes. For more information on the Homestead Declaration and the Property Tax Adjustment Claim visit wwwtaxvermontgov or contact the Vermont Department of Taxes at 802 828-2865 or 866 828-2865 toll-free in Vermont. Tax Year 2021 Instructions HS-122 HI-144 Vermont Homestead Declaration AND Property Tax Credit Claim.

How to file a Homestead Declaration. Department of Taxes Use myVTax the departments online portal to check on the filing or refund of your Vermont Income Tax Return Homestead Declaration and Property Tax Credit Renter Rebate Claim and Estimated Payments. Each person who owns property and lives on that property mustdeclare homestead this year by April 18th.

Vermont Homestead Declaration Form HS-122 Section A The Homestead Declaration must be filed annually by every Vermont resident homeowner on their primary residence as of April 1 of the calendar year.

Declaring Your Vermont Homestead Most Situations The Basics Youtube

Vermont Department Of Taxes Youtube

Vermont Department Of Taxes Facebook

Download Instructions For Form Hs 122 Vermont Homestead Declaration And Property Tax Credit Pdf 2020 Templateroller

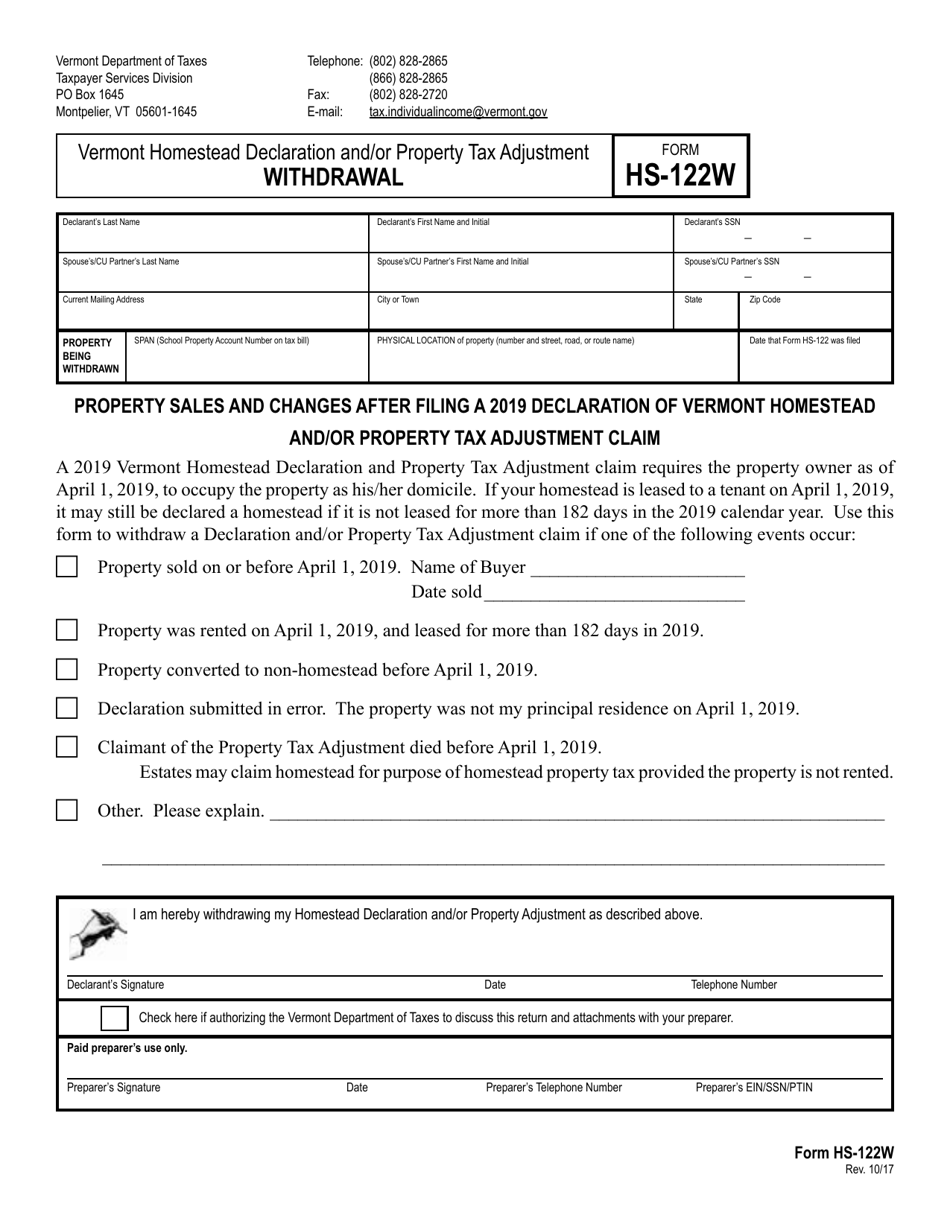

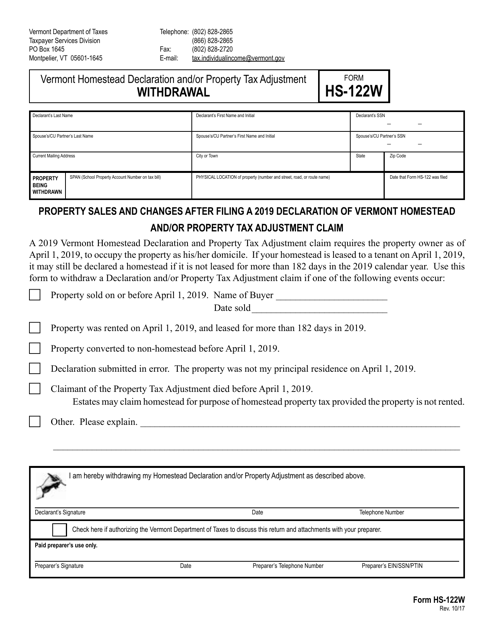

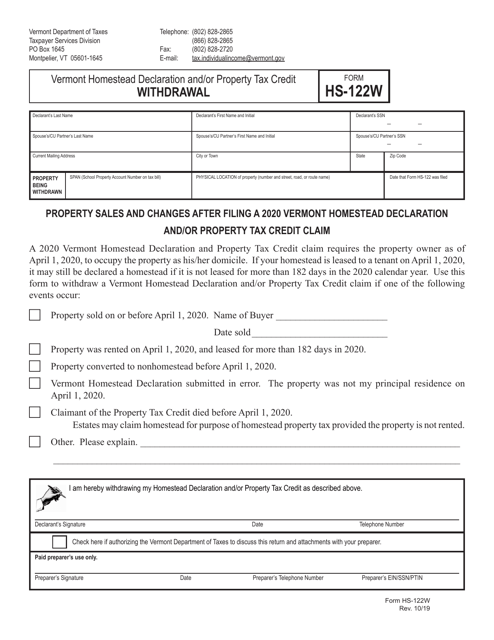

Vt Form Hs 122w Download Printable Pdf Or Fill Online Vermont Homestead Declaration And Or Property Tax Adjustment Withdrawal Vermont Templateroller

Vt Form Hs 122w Download Printable Pdf Or Fill Online Vermont Homestead Declaration And Or Property Tax Adjustment Withdrawal Vermont Templateroller

How To File A Renter Credit Claim In Myvtax Form Rcc 146 V4 Youtube

Vermont Tax Forms And Instructions For 2021 Form In 111

Welcome To South Burlington Vermont

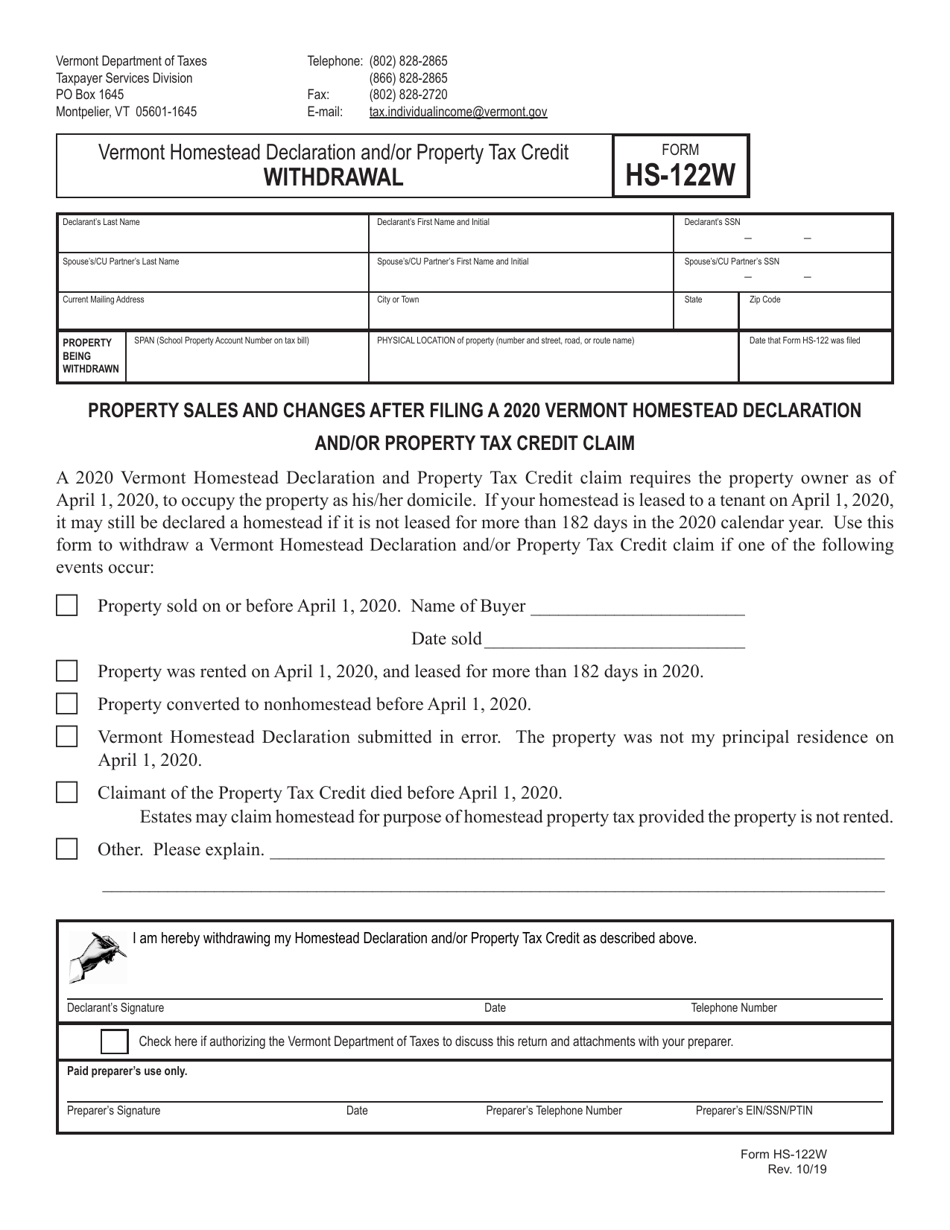

Form Hs 122w Download Printable Pdf Or Fill Online Vermont Homestead Declaration And Or Property Tax Credit Withdrawal 2020 Vermont Templateroller

Homestead Declaration Vermont Department Of Taxes Fill Out And Sign Printable Pdf Template Signnow

Form Hs 122w Download Printable Pdf Or Fill Online Vermont Homestead Declaration And Or Property Tax Credit Withdrawal 2020 Vermont Templateroller